Andover Select Board Chair Alex Vispoli wants the town to use a potential 13 percent increase in state aid to offset the 5.9 percent tax increase the select board approved in December.

Town Manager Andrew Flanagan revealed the unexpected state aid — which still needs to go through the budget process and get final approval for the state legislature — when he gave an overview of his proposed budget to the select board Monday.

“It was unexpected, and we’re looking at a big raise this year,” Vispoli said. “It would be nice if we could take that and lower the tax rate.”

More Select Board Coverage:

The average Andover single family tax bill would be $11,706, up from $11,075 this year, based on an assessment of $858,952, under the tax hike approved in December. Flanagan released a $234.8 million draft budget, which includes a 3.61 overall increase and $8.1 million in new spending, to the select board on Feb. 1.

But since Feb. 1, Gov. Maura Healey released her preliminary state budget proposal with the higher-than-projected local aid.

“This was a surprise,” Flanagan said. He recommended the additional 13 percent in state aid go to long-range planning for the town and schools, in keeping with the town’s long-range planning guidelines.

But Chair Alex Vispoli interrupted Flanagan’s presentation to ask if the money could be used to reduce the tax burden on property owners.

“It could, depending on how it’s applied, and we’re looking at the most sensible way to use it,” Flanagan said.

There is a joint meeting of the select board, school committee and finance committee on Saturday where Flanagan and his staff will give a detailed breakdown of the Fiscal 2024 budget. All three bodies will continue deliberating the budget, leading to recommendations on final approval to Town Meeting in May.

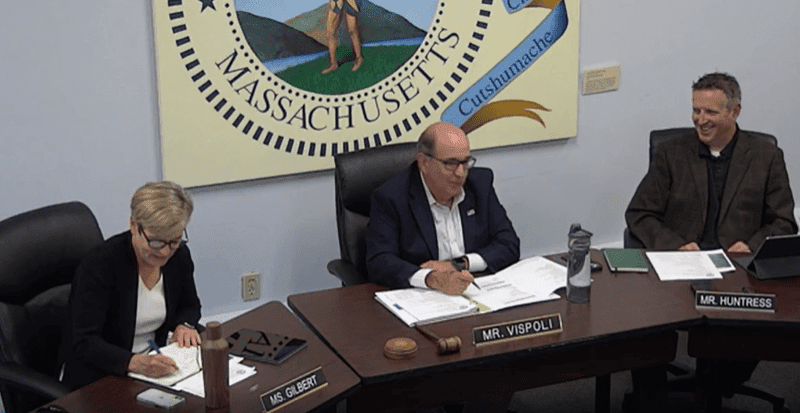

Photo: Andover Select Board Chair Alex Vispoli (file)