Andover officials got a first look at the $224.6 million budget for the fiscal year beginning July 1, 2023 that town meeting will be asked to approve in May.

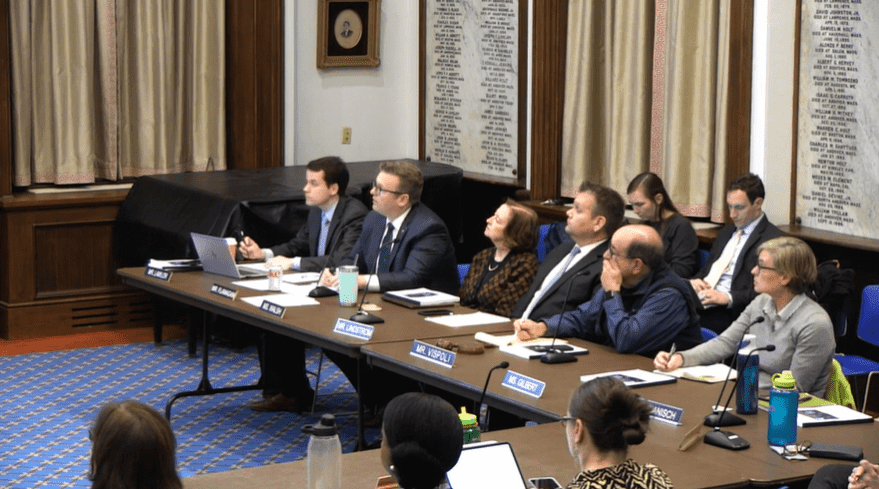

Town Manager Andrew Flanagan presented the preliminary budget and his proposed Capital Improvement Plan at a 45-minute-long tri-board meeting of the select board, school committee and finance committee at Memorial Hall Library Wednesday. Flanagan stressed the budget was preliminary and dependent on several factors, including the release of the governor’s draft budget in mid- to late-January.

“We’re at a point in time where we know a lot more than we did a month ago, but there’s still a lot to be decided,” Flanagan said at the outset of the meeting. Flanagan said the biggest drivers of the budget increase included rising costs for energy, fuel and the cost of goods and materials, thanks to rising inflation.

The select board is scheduled to set tax rates for FY 2024 when it meets Monday. Under a level tax increase outlined by Flanagan on Wednesday, the average Andover homeowner would see property taxes rise 5.7 percent to $12,404 from $11,733 this year, based on average assessed home values. The current year’s tax increase set by the select board last December was 5.9 percent.

Disproportionate shifts among the value of different property classes and how the select board decides to split the tax burden among those different classifications will impact the final number, Flanagan said.

Under the proposal, next year’s budget will rise roughly $9.7 million, or 4.5 percent from the current year’s budget of $214.9 million. The biggest portion of the operating budget includes $169 million in property tax levies, up $6.2 million or 3.8 percent from the current fiscal year. Among the other key revenue projections Flanagan presented to the Tri-Board:

- $11.3 million that is exempt from proposition 2.5 because town meeting approved debt exclusions. That money goes towards paying off bonds for the Bancroft and West Elementary School building projects, as well as a bond to fufill Andover’s pension obligations.

- $15.1 million in state funding, which will not be certain until Governor Elect Maura Healey submits her budget and it is approved by the state legislature. “There’s some uncertainty right now with the new governor. I think it will be favorable, but we don’t know,” Flanagan said.

- $12 million from 24 different categories under local receipts, including local sales taxes, meals and lodging taxes and permit fees. Flanagan said local receipts have not fully recovered from a dip during the coronavirus pandemic, “but we’re close.”

Flanagan also outlined the expense assumptions he’s working with for the FY 2024:

Video of Dec. 7 Tri-Board Meeting from Andover TV:

Agenda for Dec. 7 Andover Tri-Board Meeting: