The average Andover homeowner’s tax bill, based on an average assessment of $858,952, will be $11,733 when bills to pay for the budget approved by town meeting in May are sent out.

The rates, which were unanimously approved by the Andover Select Board Monday, raise the average homeowner’s tax bill 5.9 from $11,075 last year, and are above the town’s10-year average residential property tax increase of 3.6 percent. Homeowners could also see an additional increase, thanks to assessed property values that rose.

More coverage on Andover News: Select Board Notebook

The select board approved a shift similar to the ones approved in recent years to keep the increases mostly level across residential, commercial and industrial tax rates. The rate increased more than the 3.6 percent increase in the town’s operating budget, thanks to debt-exclusion votes to fund school construction and the town’s pensions obligations, which were previously approved by town meeting.

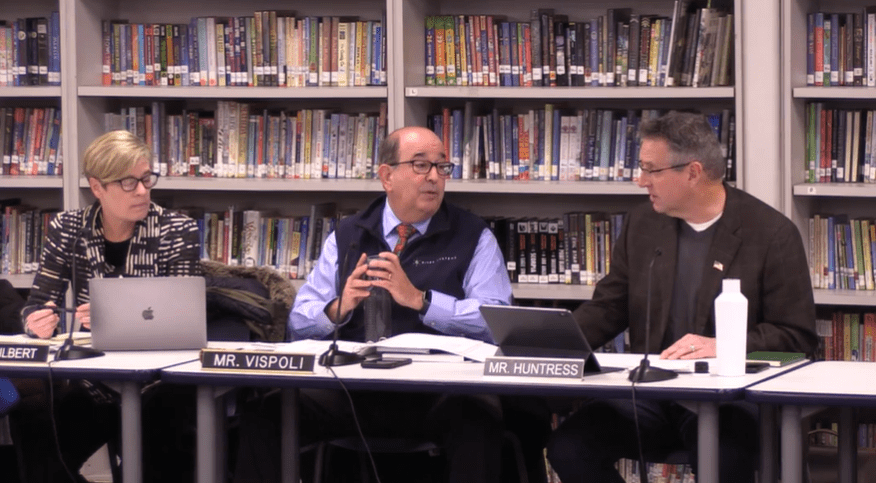

“This is the impact when you go and vote an override over the 2.5 percent” allowed under Massachusetts law for the maximum annual property tax rate increase, Chair Alex Vispoli said. “This is what happens — it stays there as long as that debt is with us.”

The residential rate approved Monday is $13.66 per $1,000 of assessed property value and $27.32 for commercial and industrial properties. The new commercial rate represents an 1.0 percent increase over this year, while the industrial rate is a 6.2 percent increase. All the percentages reflect increases in assessed value.

The average assessment for the fiscal year beginning July 1, 2023 is $858,952, up 13.2 percent from the current year’s assessment of $758,570. The average assessment for other classes of properties include:

| Property Type | FY 2024 Average | FY 2023 Average | Increase |

| Residential | $858,952 | $758,570 | 13.2% |

| Condominium | $406,912 | $371,309 | 9.6% |

| Multifamily | $716,475 | $618,126 | 16.0% |

| Commercial | $2,590,325 | $2,392,289 | 8.3% |

| Industrial | $5,828,735 | $5,118,906 | 13.9% |

The total assessed value of all properties in Andover was $10.93 billion, up 13.3 percents from $9.65 billion in the current year. The biggest year-over-year increases in total property value were industrial (13.9 percent) and residential (13.7 percents), which includes condominiums and multifamily homes.

As part of setting the tax rates Monday, the select board also considered and voted to not adopt three exemptions allowed by the state Department of Revenue. Those exemptions included:

- An open space discount, which would have exempted 25 percent of the assessed value of land classified as open space. Open space is kept in a natural state and typically have no development potential, and most of the qualifying properties in Andover are owned by the town.

- A residential exemption that would have discounted up to 35 percent of the assessed value for residential property that is the principal residence of the owner. This exemption is typically adopted in towns with high rates of seasonal rentals or in metro areas with higher densities of rental properties. Adoption of the exemption would have shifted more of the tax burden on higher-valued properties from lower-valued properties.

- A commercial exemption that would have exempted up to 10 percent of assessed commercial property values for commercial property owners who had annual employment of fewer than 10 employees and an assessed value under $1 million.